Top 20 Biopharma Companies of 2024

Shots:

- Driven by innovations and propelled by the pursuit of delivering the best-in-class therapies, 2023 remained a good year for the Biopharma Industry, despite a slight revenue decline, partly due to the conclusion of the COVID-19 pandemic

- With a CAGR of 7.8 %, the global biopharma industry is anticipated to register a market size of $799.76B by 2030. In 2023, JNJ ranked first in our list with a total reported revenue of $85.16B followed by Roche and Merck & Co. With $69.78B and $60.11B respectively

- PharmaShots brings a succinct report on the Top 20 Biopharma Companies in 2024 based on their last year's revenue

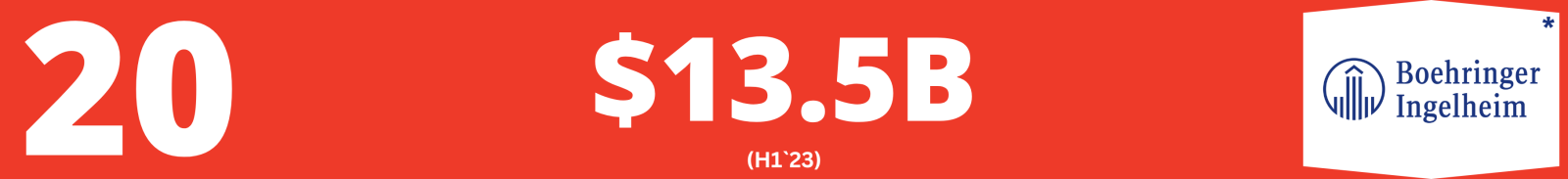

20. Boehringer Ingelheim

Total Revenue: $13.5B (H1`23)

Founded Year: 1885

Total Employees: ~53,200

Headquarters: Ingelheim, Germany

Market Cap: N/A

Stock Exchange: N/A

- A research-driven multinational private pharmaceutical company, Boehringer Ingelheim discovers, develops, and manufactures innovative healthcare products. The company operates under three business segments viz. Human Pharma, Animal Health, and Biopharma Contract Manufacturing

- In 2023, Boehringer's lead assets remained Jardiance and Ofev from its Human Pharma segment and NexGard and Ingelvac Circoflex from its Animal Health segment. Boehringer's revenue increased by 9.7% in H1`23 owing to increased sales of human and animal segment products.

- In 2023, Boehringer’s Jardiance received the US FDA approval for the treatment of adults with CKD

19. Viatris

Total Revenue: $15.42B

Founded Year: 2020

Total Employees: 38,000

Headquarters: Pennsylvania, United States

Market Cap: $13.91B

Stock Exchange: NASDAQ

- Viatris is a global healthcare company that develops, manufactures and commercializes generic and branded medicines along with consumer healthcare products. The company focuses on Respiratory, Cardiovascular, Central Nervous System (CNS), Allergy, Skin Diseases, and Oncology

- In 2023, Viatris’ Branded products generated a total revenue of $10.84B, whereas its Generic products generated a total sale of $6.97B. Its lead assets include Lipitor ($1.56B), Norvasc ($732.4M), Lyrics ($556.5M). Viatris’ 2023 revenue decreased by 5.16% vs. 2022.

- In May 2023, Viatris signed a Licensing Agreement with InDex Pharmaceuticals to develop and commercialize Cobitolimod for the treatment of Ulcerative Colitis

18. Merck KGaA

Total Revenue: $23.17B

Founded Year: 1668

Total Employees: ~63,000

Headquarters: Darmstadt, Germany

Market Cap: $70.60B

Stock Exchange: ETR

- Merck KGaA is a multination biopharma company that discovers, develops, and commercializes products targeting multiple therapy areas. The company focuses on Oncology, Cardiovascular, Diabetes, Oncology, Neurology, and Immunology

- In 2023, the company’s Cardiovascular, Metabolism, and Endocrinology section contributed significantly to the company’s total revenue with a total sale of $3.07B. Erbitux, Mavenclad, Glucophage, and Concor among others are the company’s lead assets. Merck KGaA’s total revenue declined by 2.89% as compared to 2022

- In Jun’23, Merck KGaA signed a collaboration agreement with Innovent for the clinical development of IBI351 in combination with Erbitux (cetuximab) for the treatment of Non-Small Cell Lung Cancer

17. Gilead Sciences

Total Revenue: $27.12B

Founded Year: 1987

Total Employees: 18,000

Headquarters: California, United States

Market Cap: $84.94B

Stock Exchange: NASDAQ

- Gilead Sciences discovers, develops, and commercializes innovative therapies in a single segment to meet unmet healthcare needs. With a focus on HIV, COVID-19, viral hepatitis, and oncology, Gilead continues to advance innovative medicines to prevent and treat life-threatening diseases

- The company's HIV product sales contributed $14.8B to its revenue. Its HIV segment contains products including Biktarvy, Genvoya, and Descovy, among others. Gilead’s 2023 revenue faced a slight decrease of 0.59% vs. 2022

- Gilead Sciences entered into an exclusive agreement with Compugen to exclusively license its potential first-in-class, pre-clinical antibody program against the IL-18 binding protein, including the COM503 drug candidate

16. Amgen

Total Revenue: $28.19B

Founded Year: 1980

Total Employees: 26,700

Headquarters: California, United States

Market Cap: $142.80B

Stock Exchange: NASDAQ

- Amgen is a multinational biotech company that develops and discovers therapies for cardiovascular diseases, oncology, bone health, neuroscience, nephrology, and inflammation.

- With more than 35 drugs in development phases across multiple indications, Amgen currently markets Enbrel, Prolia, Otezla, and Xgeva among others. The company’s revenue increased by 7.1% as compared to 2022. Enbrel ($3.697B) and Prolia ($4.048B) contributed significantly to its total revenue.

- In 2023, Amgen received the US FDA’s priority review of Amgen's Tarlatamab application for the treatment of advanced SCLC

15. Takeda

Total Revenue: $30.3B

Founded Year: 1781

Total Employees: ~50,000

Headquarters: Tokyo, Japan

Market Cap: $42.96B

Stock Exchange: TYO

- Takeda is a multinational pharmaceutical company focussing on five key business areas, including Gastrointestinal, Rare diseases, PDT Immunology, Oncology, and Neuroscience

- In 2023, Takeda registered a spike of 3.06 percent in revenue compared to 2022. Entyvio and Takhzyro are the most valued products of the company, producing the highest revenue compared to other products

- In 2023, Takeda’s FRUZAQLA received approval from the US FDA for previously treated metastatic colorectal cancer

14. Eli Lilly

Total Revenue: $34.12B

Founded Year: 1876

Total Employees: 43,000

Headquarters: Indianapolis, United States

Market Cap: $724.46B

Stock Exchange: NYSE

- An American pharmaceutical company, Eli Lilly focuses on bone and joint disease, cancer, cardiovascular disease, diabetes, endocrine disease, immunology, neurodegeneration, neuroscience, and pain management

- In 2023, the company's total sales registered a spike of 19.55 % owing to the increase in the sales of Mounjaro, Verzenio, and Jardiance and the sales of the rights for the olanzapine portfolio

- In 2023, Eli Lilly’s Jaypirca received the US FDA’s accelerated approval for the treatment of chronic lymphocytic leukemia or small lymphocytic lymphoma (CLL/SLL)

13. Novo Nordisk

Total Revenue: $34.39B

Founded Year: 1923

Total Employees: ~64,300

Headquarters: Bagsvaerd, Denmark

Market Cap: $429.22B

Stock Exchange: NYSE

- A Danish multinational biopharma company, Novo Nordisk discovers, develops, manufactures, and commercializes products across multiple indications

- Novo Nordisk functions mainly under two business segments i.e. Diabetes & Obesity Care and Rare Diseases. The company is also focusing on R&D in Cardiovascular & Emerging therapy areas

- In 2023, the company's total revenue increased to 35.02% as compared to 2022. In Mar 2023, Novo Nordisk signed an agreement with Valo Health to discover and develop treatments for cardiometabolic diseases

12. GSK

Total Revenue: $38.61B

Founded Year: 2000

Total Employees: ~70,200

Headquarters: London, United Kingdom

Market Cap: $84.35B

Stock Exchange: LON

- GSK is a British multinational pharma and biotech company that discovers and develops products for infectious diseases, HIV, immunology/respiratory, and oncology.

- GSK generates revenue from three segments viz. vaccines, specialty medicines, and general medicines. The top-performing products were Shingrix ($4.3B), Dovato ($2.3B), and Trelegy Ellipta ($2.8B). In 2023, the company registered an 8.82 % increase in total revenue as compared to 2022.

- GSK entered into an exclusive license agreement with Hansoh for HS-20093. Under the agreement, GSK gets the exclusive worldwide rights for clinical development and commercialization of HS-20093

11. Abbott Laboratories

Total Revenue: $40.11B

Founded Year: 1888

Total Employees: 114,000

Headquarters: Illinois, United States

Market Cap: $192.90B

Stock Exchange: NYSE

- Abbott Laboratories particularly deals in four business areas viz. pharmaceutical products, nutritional products, diagnostics, and medical devices

- The company primarily focuses on gastroenterology, women's health, cardiovascular, pain/central nervous system, respiratory, and influenza vaccines

- In 2023, Abbott reported a loss of 8.11 % as compared to 2022. Last year, Abbott completed the acquisition of Bigfoot Biomedical to develop personalized, connected solutions for diabetes patients

10. Bristol-Myers Squibb (BMS)

Total Revenue: $45.01B

Founded Year: 1887

Total Employees: 34,100

Headquarters: New Jersey, United States

Market Cap: $101.93B

Stock Exchange: NYSE

- A global biopharma company, Bristol-Myers Squib discovers, develops, and delivers innovative therapies to meet unmet healthcare needs. The company focuses on oncology, hematology, immunology, cardiovascular, and neuroscience

- Eliquis ($12.206B), Opdivo ($9.009B), and Revlimid ($6.097B) contributed significantly to the company's overall revenue. In 2023, BMS' revenue declined by 2.47% compared to 2022

- In 2023, BMS announced the acquisition of Karuna Therapeutics for a total equity value of $14B

09. Novartis

Total Revenue: $45.44B

Founded Year: 1996

Total Employees: ~19,600

Headquarters: Basel, Switzerland

Market Cap: $206.26B

Stock Exchange: SWX

- An innovative medicines company, Novartis discovers and develops products in cardiovascular, renal, metabolic (CRM), immunology, neuroscience, and oncology

- The company's top products with their contributions in the total revenue are Entresto ($6035M), Cosentyx ($4980M), Promacta/Revolade ($2.269B), and Kesimpta ($2.171B). Following the spin-off of its off-patent medicine segment in 2023, Novartis now focuses on a single business segment, i.e. innovative medicines. The company registered a decline of 10.09% in its revenue as compared to 2022.

- The company completed the acquisition of Chinook Therapeutics in 2023 for a total of $3.2B upfront cash and expects an addition of $300M on completing a regulatory milestone

08. AstraZeneca

Total Revenue: $45.81B

Founded Year: 1999

Total Employees: 89,900

Headquarters: Cambridgeshire, United Kingdom

Market Cap: $209.10B

Stock Exchange: LON

- AstraZeneca discovers and develops medicines in oncology, cardiovascular, renal, metabolic, respiratory, and immunology, vaccines and immune therapies, and rare diseases.

- The products that contributed the most to the revenue were Tagrisso ($5.799B), Imfinzi ($4.237B), and Lynparza ($3.056B). In 2023, AstraZeneca registered an increase of 3.29% in total revenue compared to 2022. The spike in the revenue can be attributed to the increase in product sales by 2 % and alliance revenue by 89% vs. 2022

- In Dec’23 AstraZeneca announced the acquisition of a clinical-stage biopharma company Icosavax

07. Sanofi

Total Revenue: $47.54B

Founded Year: 1956

Total Employees: ~11,700

Headquarters: Paris, France

Market Cap: $118.75B

Stock Exchange: NASDAQ

- A multinational French pharma and healthcare company, Sanofi researches, develops, manufactures, and markets pharmaceutical products focusing on immunology and inflammation, neurology, oncology, rare blood disorders, rare diseases, and vaccines

- Sanofi deals in two business segments: biopharmaceuticals and consumer healthcare. Sanofi's Dupixent ($11.8283B), Aubagio ($1.054B), and Influenza Vaccines ($2.9463B), contributed significantly to the company's total revenue. The company registered a decline of 6.65% in its revenue compared to 2022.

- Sanofi and Teva entered a collaboration for the development and commercialization of TEV’574 for the treatment of inflammatory bowel disease

06. Bayer

Total Revenue: $52.58B

Founded Year: 1863

Total Employees: ~99,700

Headquarters: Leverkusen, Germany

Market Cap: $29.04B

Stock Exchange: ETR

- A global life science company focused on life science, healthcare, and agriculture. The business segments of Bayer are crop science, pharmaceuticals, and consumer health. The company's therapeutic area is focused on cardiology, gynecology, diabetes, oncology, and ophthalmology.

- In 2023, Xarelto ($1.329B) and Eylea ($906.3M) remained the top contributors to the total generated revenue. This same year, Bayer faced a total decline of 3.43% in revenue collection. One of the reasons for the decline is competitive and pricing pressure from generics, especially in China and the UK.

- Bayer and CrossBay Medical entered development and option to license agreement in Nov’23 for the advancement and development of the intrauterine system inserter

05. AbbVie

Total Revenue: $54.32B

Founded Year: 2013

Total Employees: 50,000

Headquarters: Illinois, United States

Market Cap: $299.29B

Stock Exchange: NYSE

- AbbVie discovers, manufactures, and commercializes products in oncology, immunology, neuroscience, eye care, aesthetics, and other chronic and complex diseases

- In 2023, AbbVie's leading products with their revenue were Humira ($14.404B) and Skyrizi ($7.763B). The total revenue was 6.42% down compared to 2022

- AbbVie and Calibr expanded their collaboration to advance several preclinical and early-stage clinical studies

04. Pfizer

Total Revenue: $58.49B

Founded Year: 1849

Total Employees: 88,000

Headquarters: New York, United States

Market Cap: $149.04B

Stock Exchange: NYSE

- Pfizer is an American multinational company that discovers, develops, manufactures, and markets medicines and vaccines. The company operates under three business segments: Primary Care, Specialty Care, and Oncology

- In 2023, Pfizer reported a loss of 41.7% in its total revenue as compared to 2022. The decline in revenue can be attributed to reduced global sales of its COVID-19 vaccine and lead products, including Comirnaty, and Paxlovid. Ruxience ($390M) and Xalkori ($374M) remained the major contributors to 2023 revenue

- In 2023, Pfizer acquired Seagen for a total value of approx. $43B

03. Merck & Co.

Total Revenue: $60.11B

Founded Year: 1891

Total Employees: 72,000

Headquarters: New Jersey, United States

Market Cap: $321.01B

Stock Exchange: NYSE

- A research-based pharmaceutical company, Merck & Co. provides innovative solutions through its medicines, vaccines, biologic therapies, and animal health products. The company divides its business into two segments: pharmaceuticals and animal health

- In 2023, Merck & Co. registered an increase in its revenue by 1.4 % vs. 2022. The rise in revenue can be attributed to the increase in sales of Keytruda

- In Jun’23, the company completed the acquisition of Prometheus Biosciences

02. Roche

Total Revenue: $69.78B

Founded Year: 1896

Total Employees: ~103,600

Headquarters: Basel, Switzerland

Market Cap: $230.51B

Stock Exchange: SWX

- A multinational healthcare company, Roche develops innovative solutions across a wide range of therapy areas through medicines and diagnostic solutions. The company focuses on ophthalmology, oncology, neuroscience, and women's health

- In 2023, Roche's revenue increased by 1.9 %, the rise in sales can be attributed to increased demand for diagnostics and pharmaceutical products. Ocrevus ($7.6B), Hemlibra ($4.9B), and Perjeta ($4.5B) remained the major contributors to total revenue

- In 2023, Roche collaborated with Ibex Medical Analytics and Amazon Web Services to use Ibex’s AI-powered decision support tools in the pathology service for breast and prostate cancer diagnosis using the Navify Digital Pathology software platform

1. Johnson & Johnson

Total Revenue: $85.16B

Founded Year: 1886

Total Employees: 131,900

Headquarters: New Jersey, United States

Market Cap: $361.95B

Stock Exchange: NYSE

- An American multinational company, JNJ focuses on delivering innovative medicines and MedTech solutions in Oncology, Immunology, Neuroscience, Cardiovascular, Pulmonary Hypertension, and Ophthalmology

- In 2023, JNJ registered a decline of 30% in revenue due to the spin-off of its consumer health division Kenvue as compared to 2022. Stelara ($10.9B), Darzalex ($9.7B), Trevicta ($4.1B), and Imbruvica ($3.3B) remained major contributors to its total revenue

- In 2023, JNJ’s TAR-200 received the U.S. FDA’s BTD for the treatment of HR-NMIBC. Talvey, a first-in-class bispecific antibody, received the US FDA’s accelerated approval for treating adult patients with relapsed or refractory multiple myeloma (with four prior lines of therapy, including a proteasome inhibitor, an immunomodulatory agent, and an anti-CD38 antibody)

The table below showcases the revenue change in comparison to the previous year:

|

Rank |

Company |

Total 2022 Revenue |

Total 2023 Revenue |

Percentage Change |

|

1 |

Johnson & Johnson |

$94.94B |

$85.16B |

10.30% |

|

2 |

Roche |

$ 68.45B |

$69.78B |

1.94% |

|

3 |

Merck & Co. |

$59.28B |

$60.11B |

1.40% |

|

4 |

Pfizer |

$100.33B |

$58.49B |

41.70% |

|

5 |

AbbVie |

$58.05B |

$54.32B |

6.42% |

|

6 |

Bayer |

$54.5B |

$52.58B |

3.43% |

|

7 |

Sanofi |

$46.14B |

$52.58B |

6.65% |

|

8 |

AstraZeneca |

$44.35B |

$45.81B |

3.29% |

|

9 |

Novartis |

$50.54B |

$45.44B |

10.09% |

|

10 |

Bristol-Myers Squibb (BMS) |

$46.15B |

$45.01B |

2.47% |

|

11 |

Abbott Laboratories |

$43.65B |

$40.11B |

8.11% |

|

12 |

GSK |

$35.48B |

$38.61B |

8.82% |

|

13 |

Novo Nordisk |

$25.47B |

$34.39B |

35.02% |

|

14 |

Eli Lilly |

$28.54B |

$34.12B |

19.55% |

|

15 |

Takeda |

$29.40B |

$30.3B |

3.06% |

|

16 |

Amgen |

$26.32B |

$28.19B |

7.10% |

|

17 |

Gilead Sciences |

$27.28B |

$27.12B |

0.59% |

|

18 |

Merck KGaA |

$23.86B |

$23.17B |

2.89% |

|

19 |

Viatris |

$16.26B |

$15.42B |

5.16% |

|

20 |

Boehringer Ingelheim |

$25.91B |

$13.5B* |

N/A |

Sources:

- Annual reports

- SEC Filings

- Press releases

- Company websites

Market Cap Source: Google Finance (11 Apr 2024)

Currency Conversion: X-Rates (Apr 2024)

Note:

- The revenue for Roche Increased in CHF but Decreased in USD (Due to Currency Rate Drop)

Related Post: Top 20 BioPharma Companies Based on 2022 Total Revenue

Tags

An avid reader and a dedicated learner, Prince works as a Content Writer at PharmaShots. Prince possesses an exceptional quality of breaking down the barriers of words by simplifying the terms in digestible chunks to make content readable and comprehensible. Prince likes to read books and loves to spend his free time learning and upskilling himself.